FTC Disclosure Guidelines 2026: Material Connections, Platform Best Practices, and Common Mistakes

Updated requirements mandate clear disclosure of all material connections including payments, free products, affiliate links, ambassadorships, gifts, and investments across all platforms and content formats.

The Creator Economy

Editorial oversight by the Editor-in-Chief

FTC disclosure requirements have become increasingly rigorous as influencer marketing matures into a primary advertising channel. The 2026 guidelines clarify expectations, intensify enforcement, and leave no ambiguity: all material connections between creators and brands must be clearly disclosed before audiences engage with content.

What Constitutes a Material Connection

A material connection is any relationship between a creator and brand that could affect how audiences evaluate content credibility. The scope is broader than many creators realize.

Direct payment for content creation or brand promotion requires disclosure regardless of creative control retained by the creator. The issue is the financial relationship, not whether opinions are genuine.

Free products and services must be disclosed even without explicit posting requirements. If a brand sends products "for consideration," disclosure is required when posting about those products. The gift creates a material connection independent of formal obligations.

Affiliate commissions and revenue-sharing arrangements require disclosure. Any link generating creator income—Amazon Associates, LTK, platform-specific programs, or direct affiliate relationships—must be clearly labeled.

Brand ambassadorships and ongoing relationships require disclosure in every single post, not just initial announcement of the partnership. Long-term relationships do not exempt creators from per-post disclosure requirements.

Employment relationships must be disclosed when employees post about their employers on personal accounts. The employment represents a material connection that audiences deserve to know.

Personal investments and equity ownership in companies require disclosure when discussing those companies. Financial stake in success creates material connection regardless of whether formal sponsorship exists.

Gifts and perks including event invitations, travel, accommodations, or experiences must be disclosed when posting related content. The value received creates connection requiring transparency.

Family and personal relationships with brand representatives may require disclosure depending on context and nature of content.

The guiding principle: when in doubt, disclose. Over-disclosure creates no legal risk, while under-disclosure can result in enforcement action, fines, and reputation damage.

Platform-Specific Best Practices

Disclosure requirements must adapt to platform technical constraints and user behavior patterns. The FTC requires disclosures to be clear, conspicuous, difficult to miss, and in the same language as content.

Instagram Posts and Carousels: Use the built-in branded content tool which adds "Paid partnership with [Brand]" label automatically. Additionally include #ad or #sponsored in the first three lines of caption before "see more" cutoff. Place disclosure prominently, not buried among hashtags.

Instagram Stories: Use the branded content tool which adds header label. Additionally include text overlay disclosure like "Paid partnership with [Brand]" in visible location. Place disclosure at the beginning of Story series, not just at the end where viewers may not reach it.

TikTok: Use the "Branded Content" toggle which adds disclosure label to video. Include verbal disclosure when speaking in video. Add text overlay disclosure in first few seconds. Include #ad or #sponsored in caption. Multiple disclosure methods provide strongest protection.

YouTube: Check the "Includes paid promotion" box which adds disclosure. Include verbal disclosure in video itself, preferably in first 30 seconds before viewers might click away. Mention sponsorship in video description in first few lines above the fold.

Twitter/X: Include #ad or #sponsored in the tweet itself at the beginning, not buried at the end. For threads, disclose in the first tweet. Use clear language rather than vague abbreviations.

Podcasts: Include verbal disclosure read by host before or immediately at beginning of sponsored segments. Make clear when content is sponsored versus organic discussion. Include written disclosure in episode descriptions.

Blogs and Articles: Include disclosure at beginning of post, above the fold, in clear prominent formatting. Do not rely solely on links to general disclosure pages. Repeat disclosure near affiliate links within content.

Email Newsletters: Disclose sponsored content at beginning of relevant section. Clearly differentiate sponsored from editorial content using formatting like borders or different fonts. Label affiliate links when used.

The common thread: disclosures must be unavoidable and understood before audiences engage with promotional content. Platform tools help but additional disclosure provides stronger protection.

Common Mistakes That Violate Guidelines

Many creators inadvertently violate FTC requirements through practices they believe are compliant.

Burying disclosure among hashtags is insufficient. Placing #ad as the fifteenth hashtag in a long list does not constitute clear and conspicuous disclosure. It must be prominent and early in caption.

Using vague language like #sp, #spon, #collab, #ambassador, or #partner fails to clearly communicate sponsorship to average consumers. Use #ad, #sponsored, or explicit "Paid partnership with [Brand]" language.

Disclosure only in replies or comments is non-compliant. Many viewers never read comments. Disclosures must appear in original post where all viewers will see them.

Assuming platform features alone suffice creates risk. While branded content tools help, additional disclosure through hashtags, verbal mentions, or text overlays provides stronger protection and clearer communication.

Disclosing only once per long-term partnership violates requirements. Ongoing relationships require disclosure in every single post, not just the first one announcing the partnership.

Assuming monetary thresholds exist for free products is incorrect. There is no value cutoff below which disclosure is unnecessary. Even inexpensive gifted products require disclosure if they might influence content.

Using disclosure that requires action to see—hidden in "see more" text, link-outs, or requiring clicks—is not compliant. Disclosures must be immediately visible without any action required from viewers.

Relying on general disclosure pages on websites does not substitute for post-specific disclosures. Each piece of sponsored content requires its own clear disclosure.

Inadequate verbal disclosure like thanking brands at the end of long videos is less effective than clear disclosure at the beginning when all viewers are still watching.

Failing to disclose when honest opinions are shared is a violation. Disclosure is about the relationship and potential for influence, not whether opinions are genuine. Authentic enthusiasm for products still requires disclosure when material connections exist.

Enforcement and Penalties

The FTC has significantly increased enforcement activity, demonstrating that violations carry real consequences.

Warning letters sent to creators and brands become public record and damage reputation while requiring immediate compliance and responses detailing corrective actions.

Monetary penalties for violations can reach thousands or millions of dollars depending on scale and severity. While individual creators face lower penalties, brands have been fined heavily for systemic non-disclosure across influencer campaigns.

Cease and desist orders require creators and brands to stop certain practices immediately and implement compliance programs with ongoing monitoring.

Platform consequences including account suspension or bans may result from repeated violations, as platforms view non-disclosure as policy violations.

Brand relationship damage is common as companies terminate partnerships with non-compliant creators, viewing them as legal liabilities.

Audience trust damage occurs when followers discover undisclosed partnerships, often resulting in lasting reputation harm that affects long-term business viability.

Building Compliance Systems

Rather than thinking about disclosure post-by-post, professional creators implement systematic approaches.

Pre-post checklists confirm proper disclosure for any material connections before publishing content. Make disclosure review a standard part of content workflow.

Relationship tracking databases maintain records of all brand relationships, noting partnership types, start dates, and ongoing disclosure requirements.

Contract requirements should specify that disclosure is standard practice and brands support compliance. Include disclosure language in all partnership agreements.

Team training ensures everyone involved in content creation and posting understands disclosure requirements and implements them consistently.

Regular audits of published content identify any oversights or inconsistencies requiring correction.

Documentation of brand communications, payment receipts, and contract terms provides evidence of compliance if questioned.

Template disclosures for each platform and content type ensure consistency and completeness across all sponsored content.

The Business Case for Compliance

Beyond legal obligation, proper disclosure serves creator business interests.

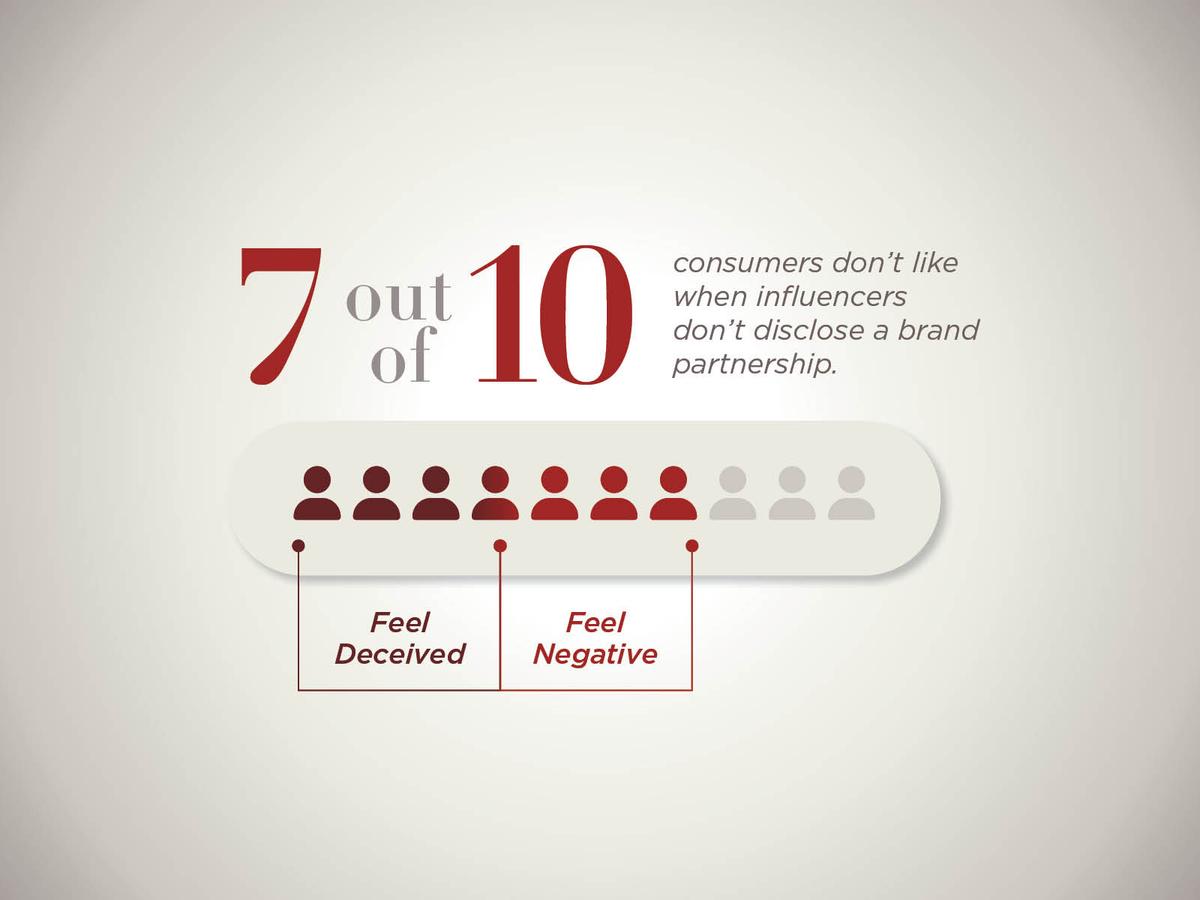

Audience trust research shows followers respect transparent creators more than those who hide commercial relationships. Transparency builds long-term trust that monetizes more effectively than deception.

Brand partnerships with reputable companies favor compliant creators who reduce legal risk. Compliance makes creators more attractive to premium partners willing to pay higher rates.

Competitive advantage accrues to compliant creators as enforcement increases and non-compliant creators face consequences. Professional standards separate serious creators from amateurs.

Legal protection from enforcement actions, lawsuits, and platform penalties protects creator businesses and reputations.

FTC compliance is not optional—it is foundational to professional creator businesses built on trust, transparency, and respect for audience intelligence. Creators who embrace disclosure as standard practice will build more sustainable businesses than those who view it as a burden to minimize.

---

**Related Articles:**

- [FTC Disclosure Requirements 2026](/post/ftc-disclosure-requirements-creators-2026) — Complete compliance guide for creators

- [Creator Unions Gain Momentum](/post/creator-unions-labor-rights-movement) — Labor rights in the creator economy

- [Brand Deal Negotiation Guide](/post/brand-deal-negotiation-guide-2026) — Compliant partnership negotiations

By The Creator Economy Editorial Team

Editorial oversight by Ismail Oyekan

Ismail Oyekan is the Editor-in-Chief of The Creator Economy and the founder of IMCX (Influencer Marketing Conference & Expo), the premier industry gathering connecting creators, brands, and capital. Named one of the 100 Most Influential People in Influencer Marketing by Influence Weekly, he has managed over $20 million in influencer marketing budgets and worked with A-list talent including Floyd Mayweather and DJ Khaled. He is a sought-after advisor to creator economy startups.